Monday, March 30, 2009

Foreclosure moratorium ends March 31st

Fannie & Freddie, with most major servicers following suit, have had a moratorium on since the Administration announced their plan. This is set to end tomorrow night.

There of course could be another moratorium announced, though the drumbeat for that hasn't been loud. And there is the extra days added for Notice of Defaults added for certain cases in the last California budget. But I think we should start seeing the additional supply hit the market by mid-May. I think this would be a good thing for the market as homes going under contract have been brisk and it is a good chance to liquidate inventory while rates are low and the tax credit is in effect.

One way you could check if foreclosures are happening is by clicking on the 3 links on the right hand side under links of the trustee sale posting companies (one requires a free signup). Put in your favorite city and watch the daily foreclosures. For the cities I've been following it has been unusual to have more than 1 or 2 foreclosures, if any at all, except for the most distressed areas. If that starts climbing to a consistent 2-5 a day that will indicate the servicers are starting to get their hands back on houses and those will eventually show up on the MLS.

Saturday, March 28, 2009

Weekly Active/Pending counts SFV & Ventura - 03/28/09

Update: Please see the home page for the latest graphs, I am reverting earlier weeks to text to maintain site speed.

San Fernando Valley:

Single Family Homes

Active - Total 2894

Active - Short sale 1052

Active - REO 339

Backup - Total 462

Backup - Short sale 185

Backup - REO 94

Pending - Total 1379

Pending - Short sale 528

Pending - REO 532

Distressed active / Total active = 48.1%

Distressed pending / Total Pending = 76.9%

Condo

Active - Total 983

Active - Short sale 498

Active - REO 138

Backup - Total 159

Backup - Short sale 78

Backup - REO 37

Pending - Total 392

Pending - Short sale 140

Pending - REO 171

Distressed active / Total active = 64.7%

Distressed pending / Total Pending = 79.3%

Ventura County:

Single Family Homes

Active - Total 1802

Active - Short sale 400

Active - REO 155

Contingent - Total 767

Contingent - Short sale 480

Contingent - REO 108

Pending - Total 646

Pending - Short sale 129

Pending - REO 302

Distressed active / Total active = 30.8%

Distressed pending / Total Pending = 66.7%

Release from Showing 291

Condo

Active - Total 634

Active - Short sale 190

Active - REO 91

Contingent - Total 265

Contingent - Short sale 178

Contingent - REO 43

Pending - Total 213

Pending - Short sale 46

Pending - REO 109

Distressed active / Total active = 44.3%

Distressed pending / Total Pending = 72.8%

Release from Showing 68

Wednesday, March 25, 2009

Ventura County Demand versus Inventory - March 2009

Tuesday, March 24, 2009

More San Fernando Valley home sale information - February 2009

Here is the various Back On Market (BOM) ratios for February 2009 home sales. Note, the local REALTOR® group uses the BOM as a % of sales as their preferred metric.

Here is the various Back On Market (BOM) ratios for February 2009 home sales. Note, the local REALTOR® group uses the BOM as a % of sales as their preferred metric.  Here are total sales, total pending and total BOM while pendings leveled off there is still a large number of homes under contract and trying to clear contingencies. I'd expect pendings to rise significantly going into summer. I am also predicting that once this rush of buyers clears through the system we will see year-over-year sales declines around July or August. Currently lenders are being hammered so I could see more of a steady rise of sales instead of a leap as the remaining understaffed lenders work off the backlog of pendings.

Here are total sales, total pending and total BOM while pendings leveled off there is still a large number of homes under contract and trying to clear contingencies. I'd expect pendings to rise significantly going into summer. I am also predicting that once this rush of buyers clears through the system we will see year-over-year sales declines around July or August. Currently lenders are being hammered so I could see more of a steady rise of sales instead of a leap as the remaining understaffed lenders work off the backlog of pendings.

This graph is identical the the graph above except for the red line. This red line is a sales estimate based on BOM and current month pendings shifted forward 60 days in time to account for escrows and reporting lag. I have no idea if it is a valid way to look at the market I'm just going to follow it for a bit to see how well it does. It is predicting total sales of around 770 next month which feels a bit low but in the ballpark.

Sunday, March 22, 2009

Ventura County December 2008 Loan To Value chart

The green shaded areas are places where private mortgage insurers are tightening and eliminating coverage. For jumbo conforming it is getting very difficult to get PMI. So FHA is the only option for loans with less than 20% down. For conforming loans it is getting difficult to get PMI above 90% LTV and this is where we see the rampant FHA activity. The Jumbo conforming loan limit was about to drop from 729k to 625k and many lenders were phasing it out by November. The jumbo conforming limit is back to 729k this year but its effect was marginal on the market to begin with.

Saturday, March 21, 2009

San Fernando Valley home sales for February 2009

San Fernando Valley single family home sales for February came in at 480. As you can see from the above charts that is still a very weak number relative to previous years but better than the all time low the year before. Sales were down 7.34 percent from January and up 34.08 percent from the year before. The median price came in at $339,900 which was down 2.89 percent from the month before and down 35.26 percent from the year earlier period. This should be the weakest month of the year as far as sales but considering the deterioration of the economy that isn't a given. As seen in earlier posts the market is only this "good" due to distressed sales and if REO or short sale inventory should slow due to government intervention sales should slow right along with them.

Condo sales came in at 162, down 2.40 percent from the month before and up 48.62 percent from the year earlier period. Median price for condos came in at $210,000 which was up 10.52 percent from January and down 36.36 from February 2008.

I'll have more regarding back on market and pendings for the San Fernando Valley later this week.

More Loan Modification Info.

Here is the "standard waterfall" formula for modification under the plan:

Step 1a: Request Monthly Gross Income.

Step 1b: Validate total first lien debt and monthly payments (PITIA). For purposes of making a provisional modification offer during the trial modification period, the borrower’s unverified income and debt payments can be used. Provisional information and modification terms will be verified in a timely manner.

Step 2: Capitalize arrearage (ED Note: This is just a fancy way of saying put back what you owe and haven't paid back on your principal balance). Servicers may capitalize accrued interest, past due real estate taxes and insurance premiums, delinquency charges paid to third parties in the ordinary course of servicing and not retained by the servicer, any required escrow advances already paid by the servicer and any required escrow advances by the servicer that are currently due and will be paid by the servicer during the Trial Period. Late fees are not capitalized.

Step 3: Target a Front-End DTI of 31%. The lender/investor shall follow steps 4, 5, and 6 to reduce the borrower’s payment to the level corresponding to the Front-End DTI Target.

Step 4: Reduce the interest rate to reach the Front-End DTI Target (subject to a floor of 2%). The note rate should be reduced in increments of 0.125 %, and should bring the monthly payment as close as possible to the Front-End DTI Target without going below 31%. If the resulting modified interest rate is at or above the Interest Rate Cap, this modified interest rate will be the new note rate for the remaining loan term. If the resulting modified interest rate is below the Interest Rate Cap, this modified interest rate will be in effect for the first five years, followed by annual increases of 1% (100 basis points) per year or such lesser amount as may be needed until the interest rate reaches the Interest Rate Cap, at which time it will be fixed for the remaining loan term.

Step 5: If the Front-End DTI Target has not been reached, extend the term of the loan up to 40 years. If term extension is not permitted extend amortization. The 40-year term begins at the start of the modification (after the borrower successfully completes the Trial Period). Note that the servicer should only extend to a term that is necessary to reach the Front-End DTI Target; there is no requirement to extend to a 40-year term.

Step 6: If the Front-End DTI Target has not been reached, forbear principal. If there is a principal forbearance amount, a balloon payment of that forbearance amount is due on the maturity date, upon sale of the property, or upon payoff of the interest bearing balance. If the modification does not pass the NPV Test and the servicer chooses to modify the loan, the modified balance must be no lower than the current property value.

Weekly Active/Pending counts SFV & Ventura - 03/21/09

I'm seeing agents put signs on properties but not on the MLS in my driving around. I think the hope is that they can keep the sale "in-house" in the face of the lack of much "good" inventory on the market. So if you are looking right now make sure to drive around the area you are interested in, you might see some places for sale you won't see online.

Update: Please see the home page for the latest graphs, I am reverting earlier weeks to text to maintain site speed.

San Fernando Valley:

Single Family Homes

Active - Total 2954

Active - Short sale 1093

Active - REO 339

Backup - Total 467

Backup - Short sale 193

Backup - REO 95

Pending - Total 1337

Pending - Short sale 508

Pending - REO 515

Distressed active / Total active = 48.5%

Distressed pending / Total Pending = 76.5%

Condo

Active - Total 1017

Active - Short sale 513

Active - REO 155

Backup - Total 149

Backup - Short sale 72

Backup - REO 35

Pending - Total 387

Pending - Short sale 144

Pending - REO 165

Distressed active / Total active = 65.7%

Distressed pending / Total Pending = 79.8%

Ventura County:

Single Family Homes

Active - Total 1861

Active - Short sale 434

Active - REO 177

Contingent - Total 706

Contingent - Short sale 457

Contingent - REO 94

Pending - Total 655

Pending - Short sale 137

Pending - REO 323

Distressed active / Total active = 32.8%

Distressed pending / Total Pending = 70.2%

Release from Showing 272

Condo

Active - Total 642

Active - Short sale 197

Active - REO 94

Contingent - Total 242

Contingent - Short sale 165

Contingent - REO 36

Pending - Total 222

Pending - Short sale 43

Pending - REO 123

Distressed active / Total active = 45.3%

Distressed pending / Total Pending = 74.8%

Release from Showing 64

Thursday, March 19, 2009

Responsible lender criticized by the FDIC

From the article:

Bad or delinquent loans?

Zero.

Foreclosures?

None.

Money set aside

in 2008 for anticipated loan losses?

Nothing.

I'm glad the FDIC took time from bailing out the irresponsible lenders to single out this bank for being too conservative.

Tuesday, March 17, 2009

Ventura County February 2009 Sales

Dataquick released its February 2009 home sales report for Southern California. For Ventura County sales came in at 545, up 10.1% from the year before and down 5.7% from the previous month. Median price came in at $327,000 which is down $118,000 (-26.5%) from the year before and down $303,000 (-48.0%) from the peak. The mix shift of the lower end foreclosures are driving any strength in sales but sales are extremely weak. Last year at this time rates were 5.92% and rates now are hovering around 5%, prices have come down a lot and yet sales were anemic. This is the seasonal low point for the year so I wouldn't put too much stock into it. Sales will improve as the initial rush of the tax credit buyers clear through the market. After that I would expect sales to slow further, possibly even go negative Year over Year and due to low end slowing sales, median price to rise a bit. This is all driven by the slow down in motivated inventory due to the foreclosure moratoriums and the deteriorating economy.

Sunday, March 15, 2009

Weekly Active/Pending counts SFV & Ventura - 03/14/09

I'm seeing agents put signs on properties but not on the MLS in my driving around. I think the hope is that they can keep the sale "in-house" in the face of the lack of much "good" inventory on the market. So if you are looking right now make sure to drive around the area you are interested in, you might see some places for sale you won't see online.

Update: Please see the home page for the latest graphs, I am reverting earlier weeks to text to maintain site speed.

San Fernando Valley:

Single Family Homes

Active - Total 3011

Active - Short sale 1117

Active - REO 348

Backup - Total 437

Backup - Short sale 191

Backup - REO 88

Pending - Total 1329

Pending - Short sale 493

Pending - REO 528

Distressed active / Total active = 48.7%

Distressed pending / Total Pending = 76.8%

Condo

Active - Total 1031

Active - Short sale 513

Active - REO 151

Backup - Total 140

Backup - Short sale 66

Backup - REO 36

Pending - Total 395

Pending - Short sale 149

Pending - REO 167

Distressed active / Total active = 64.4%

Distressed pending / Total Pending = 80.0%

Ventura County:

Single Family Homes

Active - Total 1898

Active - Short sale 455

Active - REO 186

Contingent - Total 675

Contingent - Short sale 436

Contingent - REO 95

Pending - Total 651

Pending - Short sale 137

Pending - REO 321

Distressed active / Total active = 33.8%

Distressed pending / Total Pending = 70.4%

Release from Showing 264

Condo

Active - Total 644

Active - Short sale 187

Active - REO 103

Contingent - Total 229

Contingent - Short sale 150

Contingent - REO 40

Pending - Total 224

Pending - Short sale 45

Pending - REO 125

Distressed active / Total active = 45.0%

Distressed pending / Total Pending = 75.9%

Release from Showing 64

Saturday, March 14, 2009

Mortgage interest deduction plan in the budget has major opposition

The immediate issue for buyers today, no matter their tax bracket, would be that the deduction is no longer sacred they can't plan long term that it will be as high as it is today and would have to factor that into their near term purchasing decisions. The law is written as a cap on all deductions so I think the property tax deduction would also be affected. As it is I think people overestimate the deduction affect of mortgage interest on their ability to buy as they calculate the deduction for the first year when the interest paid is highest but don't take into account amortization and the fact that interest paid reduces over the life of the loan.

From the article:

Fear that the Obama proposal could lead to future cuts to the deduction is a major concern of some opponents, said David Kissinger, director of government affairs for the South Bay Assn. of Realtors.

"If today it's households earning $250,000 who will pay more, does it mean tomorrow if they still need to balance the budget it will be those making $180,000, then $160,000? How often is the government going to go back to the well?" he said.

While I think the arguments by the NAR against the plan are overdone, the slippery slope argument does have some merit to it.

Friday, March 13, 2009

Major mortgage investors balking at the administration modification plan?

Investors who hold billions of dollars of residential mortgage-backed securities are pressing the Obama administration to make changes in its housing rescue plan.

...

Some investors say they are contemplating legal action because they think the administration's plan and legislation before Congress would violate their rights. They are particularly concerned about measures that would prevent lawsuits against mortgage servicers, which collect loan payments for the investors and are responsible for modifying loans with homeowners.

"Investors are given rights through the contracts in the securities, and we expect those rights to be honored," said Jeffrey Gundlach, chief investment officer of TCW Group Inc., which manages roughly $52 billion in residential mortgage-backed securities.

...

Mr. Grundlach says the program would be more palatable to investors if, for instance, modifications weren't given to borrowers who lied when they took out their initial mortgage.

...

Mortgage investors say that rewriting the first mortgage without touching the second violates their rights, because second mortgages are supposed to be repaid second. Modifying the first loan can help the holder of the second mortgage, because it increases the chances the loan will be repaid, they say.

...

many loans are serviced by big banks that also hold second mortgages -- and as a result have a financial interest in how these loans are handled.

I keep wondering why any group would ever want to buy a RMBS ever again.

Conforming Jumbo and Mortgage Insurance in California

Here is a summary of the private mortgage insurers I looked at..

- MGIC - Has a maximum loan amount of $650,000 for California. Will only underwrite mortgage insurance for LTV's <= 85% for those jumbo conforming loans.

- Radian - No Conforming Jumbos allowed at all. No Condos, Attached PUDs or second homes allowed for any product. 720 fico minimum required. They basically will only do 10% down conforming full doc files now.

- PMI - No Conforming Jumbos allowed in distressed markets. California is on their distressed market list.

- Genworth - No Conforming Jumbos allowed in distressed markets. California is on their distressed market list.

The only low down option for borrowers seems to be FHA. But FHA underwriting is stricter and FHA insurance is expensive. The front end ratio will stop most deals. There are other factors like how they calculate income which would disallow even more borrowers. Then of course is the minimum property requirements that must be met in order for the property to qualify for a FHA loan. Needless to say I don't think jumbo conforming loans will have much of an effect on this upcoming buying season.

Thursday, March 12, 2009

Foreclosures for February 2009

Wednesday, March 11, 2009

California Mortgage Modifications

Here are the Trustee Sales (Foreclosures) versus Total Workouts over each month in 2008:

As you can see from the above charts foreclosures were greatly affected by the various foreclosure moratoriums starting in late July.

Workout closed by type. This is the end result of the previous graphs Total Workouts line broken down by type. Account paid current means the account was brought back into good standing. Deed-in-lieu means the borrower surrendered the house and the lender voluntarily took it back without a foreclosure sale. Short sale means the borrower agreed to sell the house and the lender agreed to be paid back less than the full amount. Modification means an adjustment to the terms of the loan (see next graphic). Forebearance plan means the lender agrees to not accept payments for a few months and places the balance back onto the end of the loan to give the borrower some breathing room.

The above graphic is the previous graphics "Modification" line broken down into its constituent parts. I used some abbreviations to save space:

- IR : Interest Rate - Current Interest Rate for the loan.

- SR : Start Rate or Initial Rate - Initial Interest Rate for the Loan

- RR : Reset Rate - Rate at which the loan will reset

One thing that jumps out that Reducing Principal Balance is the lowest line on the chart and effectively zero. If borrowers are expecting significant principal reductions they will be disapointed. It simply won't happen. A borrower looking to stay in a home must expect to pay off the balance in full. While modifications are increasing the borrowers are only getting adjustment in interest rates and amortization length. This still leaves underwater borrowers underwater and unable to move (outside of short sale or foreclosure) or expect to create equity when writing out the monthly mortgage payment. Note on the second graph that the only other upward trending line besides modifications is short sales. I expect this to be the growing part of the market moving forward.

Monday, March 9, 2009

Rents falling...

Axiometrics figures show. Nationwide, effective rents fell 4% since August, dropping to an U.S. average of $930 a month. In California metro areas, six-month rent drops ranged from 3.3% in Salinas to 7.2% in the San Jose area. (Chart shows average effective rents per month and six-month percentage changes by metro area!)

A chart was also posted showing that rents for Los Angeles county dropped 6.2% in the last 6 months and dropped in Ventura County down 6.0% in the last 6 months. Vacancy rates for O.C. were also rising dramatically and while Jon didn't post the data for Ventura and Los Angeles it is safe to assume that local apartments are also seeing a dramatic rise in vacancy.

Rents are much more directly tied to wages and the underlying economy. And I think this is a reflection of how weak things are getting. I think the next step will be an even bigger migration from California to cheaper living areas.

Saturday, March 7, 2009

Some mortgage underwriting changes for the upcoming home buying season.

I think the most major change upcoming is that most major lenders are going to a 620 minimum FICO score. FHA doesn't have a minimum score in the underwriting guidelines but lenders can be restricted from selling their FHA loans if their default rates are too high (more about the recent trends of FHA defaults here). Since FHA is "it" for subprime loans right now nobody wants to lose access to that market so the lenders are putting their overlays on the lending guidelines to improve performance of their book. Not all lenders are at 620 right now but major players like Wells Fargo, Taylor Bean & Whitaker and Countrywide have announced the change. It is expected that most other lenders will be adopting this guideline as well.

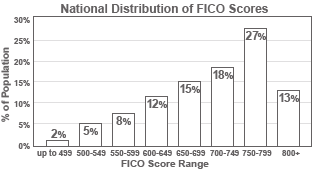

Here is the national FICO distribution so you can get a feel for the number of people affected:

The loan limits for "Conventional Jumbo" are going back up to $729,750 for Los Angeles and Ventura Counties. But as we saw from the earlier LTV charts, their effect on the market was marginal and promises to be even less effective this next year because some major mortgage insurance companies have stopped underwriting conforming jumbo loans and many others only giving insurance for conforming jumbo at 85% LTV.

Weekly Active/Pending counts SFV & Ventura - 03/07/09 (New Format)

Let me know if this slows down your browser too much. The charts are interactive so you can click on any data point and get the underlying value.

UPDATE: The graphs will only show up for the current week after that I will revert back to the text updates to improve site speed. See homepage for latest graphs.

San Fernando Valley:

Single Family Homes

Active - Total 3113

Active - Short sale 1169

Active - REO 371

Backup - Total 415

Backup - Short sale 175

Backup - REO 81

Pending - Total 1307

Pending - Short sale 486

Pending - REO 530

Distressed active / Total active = 49.5%

Distressed pending / Total Pending = 77.7%

Condo

Active - Total 1054

Active - Short sale 523

Active - REO 161

Backup - Total 132

Backup - Short sale 63

Backup - REO 31

Pending - Total 392

Pending - Short sale 142

Pending - REO 176

Distressed active / Total active = 64.9%

Distressed pending / Total Pending = 81.1%

Ventura County:

Single Family Homes

Active - Total 1890

Active - Short sale 449

Active - REO 186

Contingent - Total 665

Contingent - Short sale 427

Contingent - REO 95

Pending - Total 651

Pending - Short sale 131

Pending - REO 342

Distressed active / Total active = 33.5%

Distressed pending / Total Pending = 72.7%

Release from Showing 262

Condo

Active - Total 654

Active - Short sale 196

Active - REO 106

Contingent - Total 211

Contingent - Short sale 135

Contingent - REO 43

Pending - Total 220

Pending - Short sale 45

Pending - REO 125

Distressed active / Total active = 46.2%

Distressed pending / Total Pending = 77.3%

Release from Showing 62

Wednesday, March 4, 2009

The "Obama Plan" refinance and loan modification details.

The best place to start is of course the official website http://www.financialstability.gov/

For borrowers wanting the simplest guide to whether they generally qualify for a loan modification or refinance click here.

For a bit more detail oriented people here are the program fact sheet, summary of guidelines and modification program guidelines.

But the real meat and potatoes for true understanding the depth and breadth of the program is really found in reading the underwriting guidelines from Fannie Mae and Freddie Mac.

For Fannie Mae existing home loans they have the Home Affordable Refinance guidelines. For Fannie Mae serviced loans and even Non-GSE loans you can find the Fannie Mae Home Affordable Modification Program guidelines and also alternate options for the servicers for people who don't qualify for either option. Freddie Mac is a bit less detailed, they have two different places for refinance data, a summary type page here and a slightly more detailed guide here. The loan modification page which is linked to from their servicing guide points to here which is the old loan mod program from last year. Freddie has some work to do apparently.

Monday, March 2, 2009

San Fernando Valley Home sales estimates for February 2009

Here are the preliminary sales and price estimates for the San Fernando Valley for February 2009. Single Family Home (SFH) sales are estimated to be 465 with the median price of approximately $350,000. Condo sales are estimated to be 145 with the median price of approximately $195,000. Sales are still very weak historically but off the all time low which was set in February 2008. I am seeing a surge in pending transactions which I attribute to both seasonality, as February is the seasonal low point, and people rushing to claim the tax credit. I think the tax credit rush is a temporary effect and sales will be muted by the deteriorating local economy as we move into mid-year.

Short Sale & Foreclosure for San Fernando Valley & Ventura County - February 2009

Ventura County: