Here is the January 2009 Loan To Value chart for Ventura County. If you click and enlarge the chart it basically shows how much people are putting down at different price points. A dot at 80.0 and $300,000 means that a borrower put 20% down on a $300,000 place. This gives us a feel for how people (down payments, monthly payments and loan type) are getting into the market and where (sale price) they are getting into the market.

For jumbo conforming it is getting very difficult to get PMI. So FHA is the only option for loans with less than 20% down. For conforming loans it is getting difficult to get PMI above 90% LTV and this is where we see the rampant FHA activity. The Jumbo conforming loan limit was about to drop from 729k to 625k and many lenders were phasing it out by November. The jumbo conforming limit is back to 729k this year but its effect was marginal on the market to begin with.

For people in the market right now if you go to the left hand side and look and find around the price at which you are thinking of buying and then you can go to the right and see what your competition has done as far as down payments and loan types.

The FHA loans at the higher price ranges are, in my opinion, very risky. FHA used to be for low income people and were underwritten with lower DTI ratios. Now they are used somewhat by high income people at higher income ratios, their prospect of higher income is low and lower income is high. I think this will affect the higher end move up markets as the people who rushed to buy have little to no equity for many years. I think this is true of FHA used in massive quantities in the market like we have now (currently running 37.8% according to Dataquick). With little down it will take that much longer to buildup significant equity and long term move up and relocation transactions in the market should stay low.

Note: I have added a foreclosure research link to the site, see here.

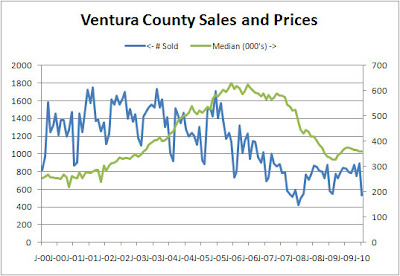

Here are the sales for Ventura County January 2011. Based on me taking statistics a bit later than usual and adjusting for recent changes in the underlying data sources I think the Dataquick number will be around 540 for December. That would be the second worst showing for January since I've been keeping records. Some of that is due to Decembers stronger showing which was a pulling forward of demand due to the spike in interest rates.

Here are the sales for Ventura County January 2011. Based on me taking statistics a bit later than usual and adjusting for recent changes in the underlying data sources I think the Dataquick number will be around 540 for December. That would be the second worst showing for January since I've been keeping records. Some of that is due to Decembers stronger showing which was a pulling forward of demand due to the spike in interest rates.