To understand the current foreclosure inventory situation you have to know how the post foreclosure process works. Once a home is foreclosed the bank will assign it to either an asset management company or even just an individual agent to get it ready for sale. The initial step is determining occupancy and getting the occupant removed and taking possession. If vacant this step doesn't take much time at all. If owner occupied and the owner doesn't want to leave then they have to go through the eviction process. If it is tenant occupied then they get at least 90 days and then if they don't leave they have to go through the eviction process. After possession is gained the house gets cleaned up for sale ("trashed out") and then priced (usually by several different BPO's being done) and finally put on market. So as you can see this will take a bit of time and at any one moment there is a "float" of homes in the pre-list stage getting these steps done. These homes aren't being withheld for any sinister reason they just haven't got ready to go onto market yet.

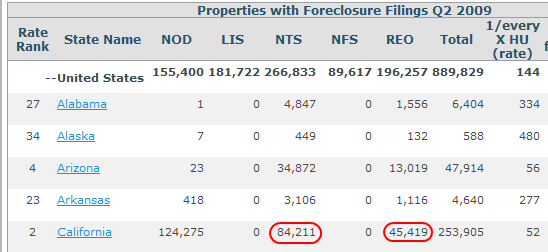

The other concept that the shadow inventory crowd needs to learn is absorption rate of homes. Doctor Housing Bubble had this graphic from the RealtyTrac report showing that shadow inventory is a huge problem waiting to engulf us all:

45,419! That's a lot... wait.. or is it? What is the context of that number relative to the number of sales. For Q2-2009 there were 121,185 homes sold in California. So that represents a little more than a third of sales. Looking at REO resales (meaning it has been taken back by the bank and then sold via auction, MLS, whatever) vs trustee sales we actually see that REO resales have been above trustee sales since the fourth quarter of 2008. REO inventory is dropping, not climbing. The net difference between REO resales and Trustee sales since the beginning of 2008 is around 30,500 homes, about a months to a month and half supply at current REO absorption rate. This number can easily be explained as mostly homes in the pre-list stage getting readied for sale.

Foreclosures are a matter of public record.. so anyone wanting to prove that shadow inventory exists should easily be able to do so. Every once and awhile you will see a REO come on the MLS and it was foreclosed on over 6 months ago (so I consider that shadow inventory) but the numbers are very small. I've searched public records and MLS data extensively to try to quantify the number of foreclosed homes sitting on the sidelines ready to come on as supply. The numbers have not been encouraging. If you give the bank/servicers any sort of realistic "float" period the homes not on market but foreclosed on becomes extremely marginal.

This is a long way of saying if you want to know how much foreclosure inventory is coming on market soon just check the monthly foreclosure reports.. the banks are basically keeping the homes flowing as fast as they can once they foreclose.

Once you accept there is no huge amount of shadow inventory already foreclosed on it brings you to the real shadow inventory. All those homes in default but not foreclosed on.. or possibly not even in the foreclosure process. Matt Padilla over at the Mortgage Insider has the following graphic:

This is the real shadow inventory.. huge swaths of homeowners in default many of which the banks haven't even put in the foreclosure process! You see ever increasing number of borrowers in default... increasing number of people in the foreclosure process... yet the percentage of people foreclosed on is dropping. This is the tremendous amount of political pressure being applied to the servicers and banks to modify loans instead of foreclose. If anyone ever argues the banks aren't doing anything for homeowners just show them this graph.

This is the real shadow inventory.. huge swaths of homeowners in default many of which the banks haven't even put in the foreclosure process! You see ever increasing number of borrowers in default... increasing number of people in the foreclosure process... yet the percentage of people foreclosed on is dropping. This is the tremendous amount of political pressure being applied to the servicers and banks to modify loans instead of foreclose. If anyone ever argues the banks aren't doing anything for homeowners just show them this graph.But just as there a concept of effective demand, that it isn't enough to want to buy you have to have the means in which to make the transaction happen, there is also effective supply. The banks or homeowners may want to sell but can't. The banks can't because of massive political pressure and the homeowners can't because they are underwater. The homeowner stops paying and the banks can't do anything about it. Everyone keeps waiting for this wave to break but it is the stated policy of the United States Government that they do not want that to happen. The USG has been winning that fight so far and there is no indication of them shifting their position anytime soon.

For more on foreclosure wave that may never break I highly recommend Sean O'Toole's "Waiting to catch a wave? Surge of REO listings is unlikely." post.

8 comments:

The term Shadow Inventory — at least the way that I use the phrase — refers to the homes purchased during the boom that are not offered for sale, but would be if the market was improved.

They are currently being rented or carried at a loss or simply owned — and as soon as prices firm up, they will hit the market.

Think of it as overhead resistance . . .

Barry,

Thanks for the comment. There is a large swath of people who think banks are holding onto foreclosed homes.

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2009/04/08/MNL516UG90.DTL&type=business&tsp=1

http://www.cnbc.com/id/32108755

http://www.foreclosuretruth.com/blog/sean/reo-inventory-hidden-shadows

http://blogs.wsj.com/developments/2009/07/21/are-banks-holding-a-shadow-inventory-of-homes/

http://www.voiceofsandiego.org/articles/2009/05/06/toscano/717shadowinventory042109.txt

http://www.doctorhousingbubble.com/shadow-housing-inventory-the-deception-of-the-foreclosure-numbers-and-the-real-reo-picture-a-case-study-of-southern-california-real-estate-how-40000-homes-are-hidden-from-public-view-by-banks/

This was to whom my post was directed.

I agree that there may not be a "sinister" reason but what's preventing the banks from "taking their sweet time" on the matter? After all, the length of time has a minimum period but an unlimited extended period.

I think the banks are manipulating the market...but since they are doing in in a legitimate way, who's the say what they are doing is illegal or immoral?

"I agree that there may not be a "sinister" reason but what's preventing the banks from "taking their sweet time" on the matter?"

Once they foreclose it makes zero economic sense to wait to sell. You're at maximum liability risk on the property and waiting also exposes you to additional depreciation for no reason.

But don't you think a flood of foreclosures on the market will destroy property values?

Do you think a flood will happen?

A flood would have to be more than 3 months of inventory dumped on the market at one time and expecting to close in a reasonable period. That would bring down values significantly.

I think anything up to a couple months inventory could be absorbed very easily by the market right now.

Will the flood happen? It's the trillion dollar question. I doubt the regulators will allow it.

I hope the flood happens because that's the only way I see prices coming down to earth.

This whole RE thing is getting truly ridiculous...so much fraud and shady crap going on...it's insane.

Keeping watching the bi-monthly trustee sale reports I post and compare the totals to the Dataquick total sales per month for the county, that would give you a heads up on an oncoming flood.

Post a Comment