I think the most major change upcoming is that most major lenders are going to a 620 minimum FICO score. FHA doesn't have a minimum score in the underwriting guidelines but lenders can be restricted from selling their FHA loans if their default rates are too high (more about the recent trends of FHA defaults here). Since FHA is "it" for subprime loans right now nobody wants to lose access to that market so the lenders are putting their overlays on the lending guidelines to improve performance of their book. Not all lenders are at 620 right now but major players like Wells Fargo, Taylor Bean & Whitaker and Countrywide have announced the change. It is expected that most other lenders will be adopting this guideline as well.

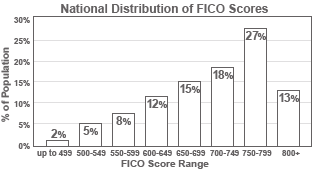

Here is the national FICO distribution so you can get a feel for the number of people affected:

The loan limits for "Conventional Jumbo" are going back up to $729,750 for Los Angeles and Ventura Counties. But as we saw from the earlier LTV charts, their effect on the market was marginal and promises to be even less effective this next year because some major mortgage insurance companies have stopped underwriting conforming jumbo loans and many others only giving insurance for conforming jumbo at 85% LTV.

4 comments:

This is incredible..with all that is happening, these idiots are laxing the lending rules again?

Just incredible.

Noz,

The jumbo conforming limit did go up but I wouldn't say lending rules are getting more lax.

I think the FHA 620 minimum will have a significant effect on the marketplace. I didn't detail what the mortgage insurers are doing (I'll add that in a few days) but the changes they are making are effectively neutralizing the increase in the conforming loan limits and even making lending in that space more restrictive than it was.

Hey ED:

Perhaps I'm misunderstanding then.

I thought the 620 score is making it easier for people to get qualified. Or am I wrong?

I'll take your word for it though...and I'm glad to see it's getting tighter honestly.

Noz,

FHA has NO Fico requirements. So any fico can get a loan.

What lenders are doing is adding a minimum FICO requirement in order to give out a loan. The reason why they would do this is so they are giving out fewer bad loans and their default rate is lower. If they have a lower default rate they won't be in danger from HUD pulling their ability to write FHA loans.

So if you look at the FICO distrubition I posted you can see this removes about 20% of the population from qualifying if all FHA lenders adopted this policy. Eventually they all will, Once the big players do this the small players suffer from adverse selection.. they get flooded with a bunch of bad loans and their book is degraded.

Post a Comment