Jon Lansner over at the OC Register points out the new tax credit will be for First Time Home Buyers only. Does this change the math much on the wastefulness of this program?

First off, Does the market need stimulating? We must have massive supply of homes just sitting on the market needing to be sold.. Right? Well looking at the facts shows otherwise. From the latest CAR report here is California's months supply of inventory. Remember 6 months is considered a balanced market. Anything under 6 months is a sellers market.

4 months! This is not a market that needs stimulating. There is a tremendous amount of supply not on the market because the government is keeping it off the market. Until that supply reaches the market the market will be supply constrained and not in need of stimulating. It is completely the wrong time for the stimulus.

4 months! This is not a market that needs stimulating. There is a tremendous amount of supply not on the market because the government is keeping it off the market. Until that supply reaches the market the market will be supply constrained and not in need of stimulating. It is completely the wrong time for the stimulus.

Now lets see how wasteful the stimulus is, here is the percentage of first time home buyers from last year:

The real question is how many new first time home buyers would buy with the stimulus. We can roughly estimate that by the national tax credit. From the NAR press release:

The real question is how many new first time home buyers would buy with the stimulus. We can roughly estimate that by the national tax credit. From the NAR press release:NAR estimates that about 1.8 to 2.0 million first-time buyers will take advantage of the $8,000 tax credit this year, with approximately 350,000 additional sales that would not have taken place without the credit.

So about 18% of sales were stimulated, some will argue they were just pulled forward instead of new sales created but we will leave that aside. That means each additional new sale costs taxpayers $54,340! Awfully expensive way of "stimulating" sales. The CBIA estimates that $16,000 is taken in for every new home sale purchased and that 3 new jobs are created per home. We can see that the number of new homes that will be purchased during the time frame will be about 3,000 but the number of new homes that wouldn't have been purchased anyways is only about 550. We can also see that the stimulus is a money loser not a money maker like the CBIA suggests :Snow noted that because building a new home generates some $16,000 in state tax revenues alone, a new tax credit would more than pay for itself.

If anyone has trouble with the way I have come up with the numbers please email on the right hand side, I'm a bit rushed this morning and don't have time to lay it all out in the post. The numbers all come from industry sources and are contained in todays and yesterdays post on this topic.The really important points to remember is that the market doesn't need stimulating and that the tax credit is an extremely expensive way of stimulating sales.

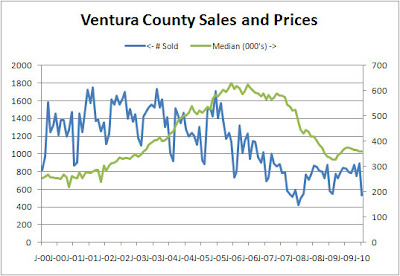

San Fernando Valley Single Family Home sales for January 2010 came in at 494 which is down 22.45% MoM and down 4.63% YoY. The median price for single family homes came in at $380,000 which is down 5.00% MoM and up 8.57% YoY. The supply constrained market is hurting sales in the SFV. Based on what I am seeing in the weekly inventory reports that doesn't appear to be changing anytime soon.

San Fernando Valley Single Family Home sales for January 2010 came in at 494 which is down 22.45% MoM and down 4.63% YoY. The median price for single family homes came in at $380,000 which is down 5.00% MoM and up 8.57% YoY. The supply constrained market is hurting sales in the SFV. Based on what I am seeing in the weekly inventory reports that doesn't appear to be changing anytime soon.

Condo sales came in at 204 which is down 13.55% MoM and up 22.90% YoY. Median price for condos came in at $215,000 which is down 10.41% MoM and up 13.15% YoY. Condos are faring much better than SFH because there is more supply due to all the new condo construction during the boom and it appears some buyers are choosing to buy a condo when they can't find what they want in a detached home.

Condo sales came in at 204 which is down 13.55% MoM and up 22.90% YoY. Median price for condos came in at $215,000 which is down 10.41% MoM and up 13.15% YoY. Condos are faring much better than SFH because there is more supply due to all the new condo construction during the boom and it appears some buyers are choosing to buy a condo when they can't find what they want in a detached home. The red line was my attempt to create a predictor for sales but it hasn't been working out so well since May of this last year. IMHO, it appears that some pendings are being double counted, instead of falling out and going BOM (which would reduce my predictor), they are just switching buyers and updating the pending date which gets them counted in the current months pendings again. This is supposition on my part since I don't know how SRAR constructs their numbers but nothing much else makes sense. Anyways the predictor is predicting sales flat for February.

The red line was my attempt to create a predictor for sales but it hasn't been working out so well since May of this last year. IMHO, it appears that some pendings are being double counted, instead of falling out and going BOM (which would reduce my predictor), they are just switching buyers and updating the pending date which gets them counted in the current months pendings again. This is supposition on my part since I don't know how SRAR constructs their numbers but nothing much else makes sense. Anyways the predictor is predicting sales flat for February.

Here is the new homes data

Here is the new homes data