From the

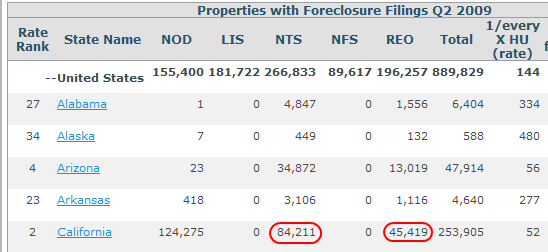

Globe and Mail, Canadian asset management company Brookfield has said they purchased an unamed (as far as I can find so far) Riverside development out of bankruptcy for 90% off peak value.

There are 3,200 unfinished McMansions sitting in a suburban Los Angeles neighbourhood, where developers spent more than $150-million (U.S.) to build sewers, grade lots and pave roads for an upscale development, only to see the market crash.

These homes are at the heart of the real estate meltdown and Toronto-based Brookfield Asset Management Inc. recently bought this Riverside, Calif., development out of bankruptcy – for 20 cents on the dollar.

...

“We do know this is currently one of the worst residential markets in the U.S.,” Mr. Flatt said in explaining the Riverside project during a conference call last Friday. “However, just to put it into perspective, the lots are within an hour of Los Angeles [and] were purchased for less than 10 per cent of the value attributed to land and infrastructure at the peak. … So these are at pretty low values.”

Here is how the purchase is described in their

press release:

“We do know this is currently one of the worst residential markets in the U.S.,” Mr. Flatt said in explaining the Riverside project during a conference call last Friday. "However, just to put it into perspective, the lots are within an hour of Los Angeles [and] were purchased for less than 10 per cent of the value attributed to land and infrastructure at the peak. … So these are at pretty low values.”

It will be interesting to see how well the investment does over the long haul but buying at 10 cents on the dollar from the peak does certainly limit the downside loss potential. I am not sure how far along the lots are but if they are fully entitled I would think they can compete with REOs if they wanted to do so.

Here are the trustee sales for Orange County for August 2009. Sales were down .9% MoM and down 38.7% YoY. Third party sales continue to come in at higher and higher levels. I have a real hard time believing all of these pencil out from an investment standpoint but maybe the market is that hot in the OC. Since some of these areas are more affluent maybe buyers are just surpassing traditional buying avenues and buying themselves.

Here are the trustee sales for Orange County for August 2009. Sales were down .9% MoM and down 38.7% YoY. Third party sales continue to come in at higher and higher levels. I have a real hard time believing all of these pencil out from an investment standpoint but maybe the market is that hot in the OC. Since some of these areas are more affluent maybe buyers are just surpassing traditional buying avenues and buying themselves.