There was a point in time where various housing bloggers were talking about "shadow inventory" as houses taken back by the bank and purposely kept off the market. According to these bloggers this horde was supposed to be released en masse and flood the market. It was a great, sexy story and I never saw any making much effort to prove or disprove if it was actually happening. Since trustee sales are a matter of public record I went and matched up all trustee's deeds that never made it to the MLS and it turned out to be a trivial sum when you accounted for turnaround time for eviction, trashout, bpo's, and all the other stuff that happens before the houses hit the market. This data was not well received by those bloggers espousing that version of the shadow inventory opinion but they have since changed their tone to the "other" version of shadow inventory. The other housing bloggers talk about "shadow inventory" in the terms of number of delinquent borrowers... this is a very very large number. But in terms of houses foreclosed but not on the market, it is very small. In short, If there is going to be a tsunami that floods the market it will be trivial to see coming before it hits.

This is a simple graph to show the accumulation (or lack thereof) of REO inventory. When the blue line is above the green line REO inventory could be accumulating. I say "could be" because the green line is merely the number of homes sold during the quarter that were foreclosed in the past 12 months, so investors trustee flips would be captured in the data as well. I think the blue line will elevate somewhat but the two lines will stay pretty close as it makes little sense to foreclose and not market the home.I am very doubtful of the tsunami theory simply because the government has said it is not what they wish to happen and they have gone to great lengths for it not to happen. What we will have instead is stagnation in the market for a very very long time. I have been assured by people much smarter than I that this is "better". It very well could be better for some but it is worse for others and this choosing of who wins and who loses is fine if you win and a kick in the nuts if you lose. One can guess which side I am on.

This is a simple graph to show the accumulation (or lack thereof) of REO inventory. When the blue line is above the green line REO inventory could be accumulating. I say "could be" because the green line is merely the number of homes sold during the quarter that were foreclosed in the past 12 months, so investors trustee flips would be captured in the data as well. I think the blue line will elevate somewhat but the two lines will stay pretty close as it makes little sense to foreclose and not market the home.I am very doubtful of the tsunami theory simply because the government has said it is not what they wish to happen and they have gone to great lengths for it not to happen. What we will have instead is stagnation in the market for a very very long time. I have been assured by people much smarter than I that this is "better". It very well could be better for some but it is worse for others and this choosing of who wins and who loses is fine if you win and a kick in the nuts if you lose. One can guess which side I am on.

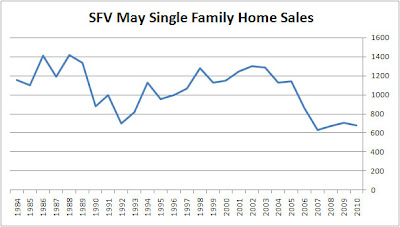

Here is the sales breakdown for the San Fernando Valley for June 2010. The SFV has a lot more late reporters as a percentage of sales and so it is a bit tougher to discern right now just how weak sales will ultimately be for May. It appears that sales should be even YoY when all the late reporters are counted. These sales levels are extremely weak historically and just an indication of this highly engineered market. With the end of the tax credit it appears it is going out with a whimper not a bang, it looks like the SFV will be down slightly YoY when the late reporters check in.

Here is the sales breakdown for the San Fernando Valley for June 2010. The SFV has a lot more late reporters as a percentage of sales and so it is a bit tougher to discern right now just how weak sales will ultimately be for May. It appears that sales should be even YoY when all the late reporters are counted. These sales levels are extremely weak historically and just an indication of this highly engineered market. With the end of the tax credit it appears it is going out with a whimper not a bang, it looks like the SFV will be down slightly YoY when the late reporters check in.