skip to main |

skip to sidebar

Note: I know that the weekly inventory reports are broken. Google broke their chart widgets and are working on restoring them.

Here are the sales for Ventura County for May 2010. Sales are still very low, with late reporters I expect the official Dataquick numbers will be up slightly YoY at around 810 sales. This continued stagnation in the market is the same boring story, less supply due to government intervention trying to keep prices high at all costs. If you watch the weekly inventory report you can see the market weakening even in the face of sub-5% rates, contingents and pendings falling, sales stagnant. All this with massive incentives and choked off supply.. it is clearly a vain attempt to keep the market propped up. I fully expect more housing incentives to hit the market they will just have to wait until after the November elections.

Here are the sales for Ventura County for May 2010. Sales are still very low, with late reporters I expect the official Dataquick numbers will be up slightly YoY at around 810 sales. This continued stagnation in the market is the same boring story, less supply due to government intervention trying to keep prices high at all costs. If you watch the weekly inventory report you can see the market weakening even in the face of sub-5% rates, contingents and pendings falling, sales stagnant. All this with massive incentives and choked off supply.. it is clearly a vain attempt to keep the market propped up. I fully expect more housing incentives to hit the market they will just have to wait until after the November elections.

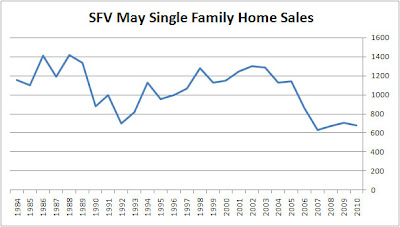

Here is the sales breakdown for the San Fernando Valley for May 2010. The SFV has a lot more late reporters as a percentage of sales and so it is a bit tougher to discern right now just how weak sales will ultimately be for May. It appears that sales should be even YoY when all the late reporters are counted. These sales levels are extremely weak historically and just an indication of this highly engineered market. With the end of the tax credit it appears it is going out with a whimper not a bang.

Here is the sales breakdown for the San Fernando Valley for May 2010. The SFV has a lot more late reporters as a percentage of sales and so it is a bit tougher to discern right now just how weak sales will ultimately be for May. It appears that sales should be even YoY when all the late reporters are counted. These sales levels are extremely weak historically and just an indication of this highly engineered market. With the end of the tax credit it appears it is going out with a whimper not a bang.

San Fernando Valley Single Family Home sales for May 2010 came in at 679 which is up 5.43% MoM and down 4.10% YoY. This is the eighth straight month of YoY declines and the third worst May sales on record. The median price for single family homes came in at $385,000 which is down 1.58% MoM and up 10.00% YoY. The supply constrained market is hurting sales in the SFV. Supply is still down YoY but that looks to change by mid-year if the trend of low sales and rising inventory holds.

San Fernando Valley Single Family Home sales for May 2010 came in at 679 which is up 5.43% MoM and down 4.10% YoY. This is the eighth straight month of YoY declines and the third worst May sales on record. The median price for single family homes came in at $385,000 which is down 1.58% MoM and up 10.00% YoY. The supply constrained market is hurting sales in the SFV. Supply is still down YoY but that looks to change by mid-year if the trend of low sales and rising inventory holds.

Condo sales came in at 213 which is down 1.84% MoM and down 5.75% YoY. Median price for condos came in at $233,000 which is down 6.80% MoM and up 25.94% YoY. Condos are faring better than SFH because there is more supply due to all the new condo construction during the boom and it appears some buyers are choosing to buy a condo when they can't find what they want in a detached home. Sales are still extremely low historically, just not as bad as SFH.

Condo sales came in at 213 which is down 1.84% MoM and down 5.75% YoY. Median price for condos came in at $233,000 which is down 6.80% MoM and up 25.94% YoY. Condos are faring better than SFH because there is more supply due to all the new condo construction during the boom and it appears some buyers are choosing to buy a condo when they can't find what they want in a detached home. Sales are still extremely low historically, just not as bad as SFH. The line that is most interesting in this graph is the top green line. This denotes pending sales booked in May. Notice the large (20.9%) decrease during prime buying season. The red line is predicting a sales increase for June but May's predicted increase was muted. June will be tepid and July may be cliff diving. There is evidence of a very weak May home shopping season in the national news as well. It looks like things could start to get interesting again.

The line that is most interesting in this graph is the top green line. This denotes pending sales booked in May. Notice the large (20.9%) decrease during prime buying season. The red line is predicting a sales increase for June but May's predicted increase was muted. June will be tepid and July may be cliff diving. There is evidence of a very weak May home shopping season in the national news as well. It looks like things could start to get interesting again.